We continue to reflect on Capgemini’s acquisition of Altran.

We continue to reflect on Capgemini’s acquisition of Altran.

Capgemini is to acquire Altran, for €5.0bn, including €3.6bn in cash and Altran’s net debt of €1.4bn (gross debt of €1.8bn). The company has already secured the 11% stake in Altran that Apax Partners holds and will rely on the financing, on its €1bn cash position and a €4.4bn bond issue.

Cognizant has been making more headlines in ER&D services, recently. Last month, we had mentioned its

We had to look back into our database to identify when Wipro had, for the last time, acquired an ER&D service vendor. In 2005-2006, Wipro acquired three ER&D services (Saraware, NewLogic, and Quantec) around semi-conductors and PLM services. And then, nothing for the following thirteen years.

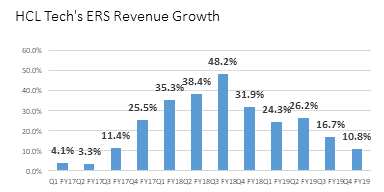

HCL Tech’s ERS unit posted an excellent growth of +12.1% yoy at CC. The growth positioned ERS as the second fastest ER&D services vendor (among top ten vendors) behind Alten, ahead of Altran. ERS’s growth is, however, slowing from its peak of +47.7% at CC in Q3 FY18.

ERDservices.org rarely reports about Cognizant, the NJ-headquartered but India-centric IT services giant in the space of ER&D services. Despite its size (2018 revenues of USD 16.1bn) and high-growth, Cognizant is little-visible in the ER&D area and is not a significant player in this industry.

Accenture continues to deploy its M&A strategy and has made its fifth acquisition for Industry X.0. The company acquired Zielpuls, an ER&D vendor servicing the German automotive industry. Zielpuls is an embedded systems specialist.

Altran provided some light on January 24, 2019, cyber attack that affected its operations in several countries in Europe. The company isolated malware and avoided its contamination and propagation to clients. Altran’s systems are now up and running.

Altran achieved in Q1 2019 a CC/CS growth yoy of 8.1% despite the impact of the decline in revenues of Aricent (-2% at CC/CS) and its cyber-attack (impacting the revenue growth of Altran by 200 bps).

Altran has phased out the Aricent brand in North America and now trades under the Altran brand. The company highlights it now has three primary brands: Aricent for its core ER&D services, Cambridge Consultants for its “innovation consulting” capabilities, and Frog for product design

We are now entering the season for Q1 earnings, and as always we will look into changes in major trends. The state of the automotive industry will be an area we will be closely monitoring.

Become a ERD Services premium reader to access all of your content, by contacting us at dominique@ERDservices.org.

Accenture has opened a new “Industry X.0 Innovation” center. The new center is located in Bilbao, Spain, once an industrial city that has grown significantly in the past twenty years.

If you follow what’s going in India, you are probably well aware that the manufacturing conglomerate Larsen & Toubro (L&T) has acquired 20.3% of Mindtree, from a passive promoter (the Indian term for key shareholders, usually founders).

With the launch of Industry X.0 last year, Accenture had voiced its intention to enter the ER&D services, starting by IoT and digital technologies. During the summer of 2018, the company had acquired two embedded software specialists and one product design firm. The scale of the acquisition was relatively modest with a combined ~450 consultants added

Altran reassured investors with its Q4 2018 and full-year 2018 results.

We have created an interim ranking of the top ten ER&D service vendors. Several large ER&D

Luxoft’s Automotive and Transportation unit had a stellar performance in Q3 FY19, with revenue growth of +56%.

The revenue growth of HCL Tech’s ERS unit continued to be high in Q3 FY19 to 17.4% yoy at CC. Revenues well above the half-billion threshold, to USD 562m, comforting HCL Tech as the third largest ER&D service vendor globally.

Become a ERD Services premium reader to access all of your content, by contacting us at dominique@ERDservices.org.

We have written two blogs about Luxoft’s ERD services capabilities, with this one focusing on automotive engineering.

NelsonHall has published a new blog about this week’s big news: the acquisition by DXC Technology of Luxoft.

DXC, the third largest IT service vendor is to acquire Luxoft, a Central and European delivery vendor providing IT and ER&D services. DXC is offering $2bn for Luxoft, which has been struggling this year, being impacted by its high client concentration.

It is striking to see how few onshore ER&D service vendors have built a significant Indian or nearshore presence. Onshore vendors do acknowledge that the Indian ER&D service vendors grow faster than they do but argue that most of the Indian vendors service U.S. clients or industries (mostly, ISVs, technology vendors and telecom equipment manufacturers) they do not quite address.

2018 was an eventful year: the top ER&D vendors accelerated their M&A activities. Alten continued to deploy its business model. HCL Tech’s ERS unit had a superb year