Become a ERD Services premium reader to access all of your content, by contacting us at dominique@ERDservices.org

Become a ERD Services premium reader to access all of your content, by contacting us at dominique@ERDservices.org

We missed an important acquisition that QuEST Global announced at the end of June. QuEST has acquired Dakota Moon Enterprises (DME).

Become a ERD Services premium reader to access all of your content, by contacting us at dominique@ERDservices.org

Become a ERD Services premium reader to access all of your content, by contacting us at dominique@ERDservices.org

Become a ERD Services premium reader to access all of your content, by contacting us at dominique@ERDservices.org

We have highlighted several times that the pharmaceutical sector represents ~25% of all R&D spending globally, more than automotive and aerospace. Still, very few vendors service pharma clients, and when they do, they provide manufacturing-related engineering services but never target R&D departments.

NelsonHall has posted an analysis of the Capgemini acquisition of Altran. NelsonHall is taking a Capgemini and IT services perspective, whereas, in this blog, we have made comments with our ER&D lenses. Enjoy.

HCL Tech has closed the acquisition of several IBM products. The company has now ownership of AppScan, BigFix, Commerce, Connections, Digital Experience (Portal and Content Manager), Notes Domino, and Unica. We assume the price of the transaction has not changed and still is USD 1.8bn.

We continue to reflect on Capgemini’s acquisition of Altran.

Capgemini is to acquire Altran, for €5.0bn, including €3.6bn in cash and Altran’s net debt of €1.4bn (gross debt of €1.8bn). The company has already secured the 11% stake in Altran that Apax Partners holds and will rely on the financing, on its €1bn cash position and a €4.4bn bond issue.

Cognizant has been making more headlines in ER&D services, recently. Last month, we had mentioned its

Become a ERD Services premium reader to access all of your content, by contacting us at dominique@ERDservices.org

On the same week Dassault Systemes made its largest acquisition ever, PTC acquire a small Netherlands-based IT services firm that is specialized in creating AR-based use cases. TWNKLS has a headcount of 36.

Become a ERD Services premium reader to access all of your content, by contacting us at dominique@ERDservices.org

We usually do not comment on the M&A activities of major PLM ISVs. However, Dassault Systèmes’ acquisition of Medidata, an NYC-headquartered ISV specialized in software to manage clinical trials and commercial launches, is worth a thought or two.

We had to look back into our database to identify when Wipro had, for the last time, acquired an ER&D service vendor. In 2005-2006, Wipro acquired three ER&D services (Saraware, NewLogic, and Quantec) around semi-conductors and PLM services. And then, nothing for the following thirteen years.

05, 2019

Infrastructures, Sweco

Become a ERD Services premium reader to access all of your content, by contacting us at dominique@ERDservices.org

Become a ERD Services premium reader to access all of your content, by contacting us at dominique@ERDservices.org

AE Industrial Partners, which also owns Belcan, continues to adjust the business portfolio of CDI Corp. CDI sold its Management Recruiters International (MRI) business.

In ER&D’ world of embedded systems, IoT, analytics, and EVs, ÅF Pöyry’s new consulting service comes as fresh air.

The purpose of ERDservices.org is and remains the ER&D industry across embedded systems, mechanical engineering, digital

Become a ERD Services premium reader to access all of your content, by contacting us at dominique@ERDservices.org

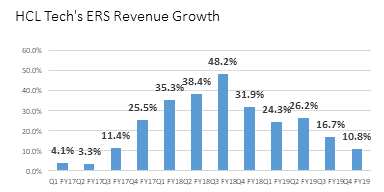

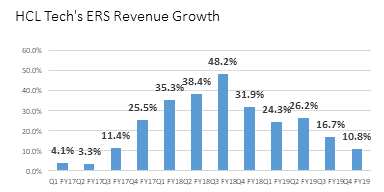

HCL Tech’s ERS unit posted an excellent growth of +12.1% yoy at CC. The growth positioned ERS as the second fastest ER&D services vendor (among top ten vendors) behind Alten, ahead of Altran. ERS’s growth is, however, slowing from its peak of +47.7% at CC in Q3 FY18.

KPIT published its first results since its IPO, as India’s third-largest ER&D services pure-play. Growth slowed down significantly in Q4 FY19, revenues up 13.4% yoy to USD 71m. The company’s EBITDA margin was 12.8%.

Become a ERD Services premium reader to access all of your content, by contacting us at dominique@ERDservices.org