Assystem Sells Assystem Care to Expleo to Accelerate Growth As disclosed during its H1 2021 results,

Assystem Sells Assystem Care to Expleo to Accelerate Growth As disclosed during its H1 2021 results,

ER&D services largest pure-play, Alten, has ambitions as a clinical trials contract research organization (CRO). During Q2 2021, the company completed the acquisition of Cmed. Cmed, a clinical trial CRO based in the UK. It is a small firm with EUR 20m in revenues and 180 consultants. It has specialized in oncology, immuno-oncology, cell therapy, and rare disease.

Become a ERD Services premium reader to access all of your content, by contacting us at dominique@ERDservices.org.

Charles River Labs (CRL) will gain further expertise for biotechs. The company is to acquire San Francisco-based Distributed Bio, a large molecules specialist firm focusing on antibody discovery. Distributed Bio will become part of CRL’s core R&D business, Discovery & Safety Assessment.

We rarely talked about Denmark-based NNIT. The company is the former IT captive of Danish pharmaceutical firm Novo Nordisk, thus the name NNIT, which stands for Novo Nordisk IT.

In August, CRL acquired a small firm, Cellero, headquartered close to Boston for USD 38m. Cellero brought a geography presence to HEMA (which is based in California).

Dassault Systems lowered it Q1 2020: the company is now expecting revenue growth in the range of 14%-17%, down from a 20-23% guidance (that includes the acquisition of Medidata). The company has suffered from weaker than expected new license and services revenues. Meanwhile, revenues of Medidata were on a “momentum and license renewals were up too.

eeva is a Wall Street darling with an eye-popping market cap of $21bn. The uniqueness of Veeva is that its SaaS applications run on top of Salesforce’s Clouds. This approach positions Veeva in the high-growth ecosystem of Salesforce (which grows by 20-25% each year).

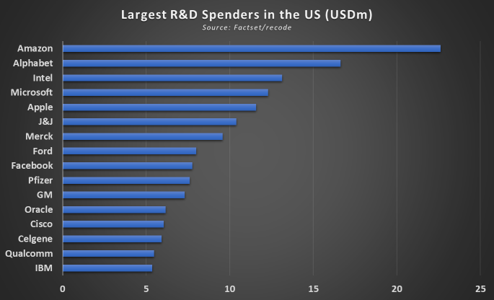

We are expecting a slowdown in ER&D spending in 2020. Learn more here.

It has been almost three years since Accenture launched Industry X.0, and we estimate that Accenture acquired nine competitors in these 36 months. The pace is accelerating with Accenture having five competitors in 2019, YTD.

Become a ERD Services premium reader to access all of your content, by contacting us at dominique@ERDservices.org

Become a ERD Services premium reader to access all of your content, by contacting us at dominique@ERDservices.org

We have highlighted several times that the pharmaceutical sector represents ~25% of all R&D spending globally, more than automotive and aerospace. Still, very few vendors service pharma clients, and when they do, they provide manufacturing-related engineering services but never target R&D departments.

Cognizant has been making more headlines in ER&D services, recently. Last month, we had mentioned its

Become a ERD Services premium reader to access all of your content, by contacting us at

Become a ERD Services premium reader to access all of your content, by contacting us at

Become a ERD Services premium reader to access all of your content, by contacting us at

Become a ERD Services premium reader to access all of your content, by contacting us at

Become a ERD Services premium reader to access all of your content, by contacting us at

Become a ERD Services premium reader to access all of your content, by contacting us at