We eagerly awaited the earnings from Altran in H1 2019 to understand if Aricent would resume growth, as guided by Altran.

We eagerly awaited the earnings from Altran in H1 2019 to understand if Aricent would resume growth, as guided by Altran.

Become a ERD Services premium reader to access all of your content, by contacting us at dominique@ERDservices.org

KPIT published its Q1 FY20, its second quarterly earnings since it became an automotive ER&D pure-play, since the sale of its IT service business to Birlasoft, last year.

After the profit warning of EDAG in July, Germany’s largest automotive ER&D pure-play, Bertrandt, also issued a profit warning. The company lowered its EBIT margin range guidance to 5%-7.5%, down from 7%-9% previously. Bertrandt is suffering from project delays and low utilization rates.

Become a ERD Services premium reader to access all of your content, by contacting us at dominique@ERDservices.org

Become a ERD Services premium reader to access all of your content, by contacting us at dominique@ERDservices.org

EDAG issued last night a profit warning for its full-year 2019 operations. The company is now expecting revenue growth by approximately 1% (previous guidance 5%), an adjusted EBIT margin of 4%-5% (previously 5%-7%), and a net profit of EUR 10m.

Become a ERD Services premium reader to access all of your content, by contacting us at dominique@ERDservices.org

Cyient’s revenues in Q1 FY20 declined, slightly, by 2.6% yoy. The decline came as a surprise as the company had signaled it had bottomed out in Q4 FY19.

Become a ERD Services premium reader to access all of your content, by contacting us at dominique@ERDservices.org

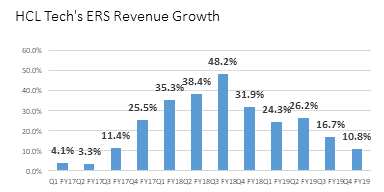

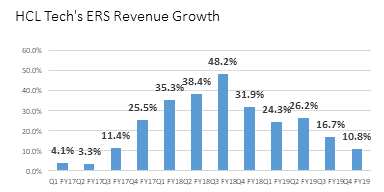

HCL Tech’s ERS unit posted an excellent growth of +12.1% yoy at CC. The growth positioned ERS as the second fastest ER&D services vendor (among top ten vendors) behind Alten, ahead of Altran. ERS’s growth is, however, slowing from its peak of +47.7% at CC in Q3 FY18.

KPIT published its first results since its IPO, as India’s third-largest ER&D services pure-play. Growth slowed down significantly in Q4 FY19, revenues up 13.4% yoy to USD 71m. The company’s EBITDA margin was 12.8%.

Become a ERD Services premium reader to access all of your content, by contacting us at dominique@ERDservices.org

LTTS continued to be impressive in FY19: the company grew revenues completed by 26.5% at CC (almost purely organic) to USD 723m. LLTS has now taken over Cyient as India’s largest listed ER&D pure-play.

Become a ERD Services premium reader to access all of your content, by contacting us at dominique@ERDservices.org

Akka has a somewhat soft financial performance in Q1 2019. The company’s organic (CC/CS) revenue growth reached 6.6%, impacted by a lesser number of working days yoy, a 0.5% sequential decrease in its headcount, and by high attrition (20.8%, up by 230 bps yoy).

Alten impressed, again, with its growth performance. In Q1 2019, revenue growth (at CC/CS yoy) reached +12.5%, to EUR 643m. This quarter, Alten added almost EUR 100m in revenues, two-thirds of it through organic growth and one third through acquisitions. The Forex impact was negligible.

Become a ERD Services premium reader to access all of your content, by contacting us at dominique@ERDservices.org.

Altran achieved in Q1 2019 a CC/CS growth yoy of 8.1% despite the impact of the decline in revenues of Aricent (-2% at CC/CS) and its cyber-attack (impacting the revenue growth of Altran by 200 bps).

Become a ERD Services premium reader to access all of your content, by contacting us at dominique@ERDservices.org.

Cyient warned investors that its Q4 FY19 would not be as good as expected. The company saw softness in both its services and DLM activities.

Assystem’s 2018 earnings were in line with its guidance. The company already had communicated its revenue performance, with a disappointing H1 (+0.8% at CC/CS) and a very good H2 (+13.2%).

Altran reassured investors with its Q4 2018 and full-year 2018 results.

Become a ERD Services premium reader to access all of your content, by contacting us at dominique@ERDservices.org.

Become a ERD Services premium reader to access all of your content, by contacting us at dominique@ERDservices.org.