You may have noticed we had not reported HCL Tech’s Q1 FY20 earnings. HCL has changed the way its reports its segments.

You may have noticed we had not reported HCL Tech’s Q1 FY20 earnings. HCL has changed the way its reports its segments.

KPIT published its Q1 FY20, its second quarterly earnings since it became an automotive ER&D pure-play, since the sale of its IT service business to Birlasoft, last year.

Cyient’s revenues in Q1 FY20 declined, slightly, by 2.6% yoy. The decline came as a surprise as the company had signaled it had bottomed out in Q4 FY19.

We missed an important acquisition that QuEST Global announced at the end of June. QuEST has acquired Dakota Moon Enterprises (DME).

HCL Tech has closed the acquisition of several IBM products. The company has now ownership of AppScan, BigFix, Commerce, Connections, Digital Experience (Portal and Content Manager), Notes Domino, and Unica. We assume the price of the transaction has not changed and still is USD 1.8bn.

Cognizant has been making more headlines in ER&D services, recently. Last month, we had mentioned its

We had to look back into our database to identify when Wipro had, for the last time, acquired an ER&D service vendor. In 2005-2006, Wipro acquired three ER&D services (Saraware, NewLogic, and Quantec) around semi-conductors and PLM services. And then, nothing for the following thirteen years.

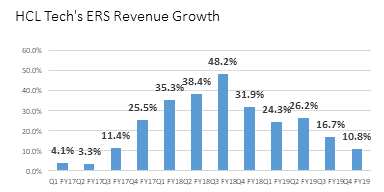

HCL Tech’s ERS unit posted an excellent growth of +12.1% yoy at CC. The growth positioned ERS as the second fastest ER&D services vendor (among top ten vendors) behind Alten, ahead of Altran. ERS’s growth is, however, slowing from its peak of +47.7% at CC in Q3 FY18.

KPIT published its first results since its IPO, as India’s third-largest ER&D services pure-play. Growth slowed down significantly in Q4 FY19, revenues up 13.4% yoy to USD 71m. The company’s EBITDA margin was 12.8%.

LTTS continued to be impressive in FY19: the company grew revenues completed by 26.5% at CC (almost purely organic) to USD 723m. LLTS has now taken over Cyient as India’s largest listed ER&D pure-play.

Last week, KPIT Technologies, returned to India’s BSE and NSE. The company now has a market cap of approximately USD 410m with its share was introduced at a price of INR 99 and traded in the past few days between INR 103 and INR 115. KPIT has succeeded in its IPO and is now an ER&D service pure-play having sold its IT services business to Birlasoft.

We are now entering the season for Q1 earnings, and as always we will look into changes in major trends. The state of the automotive industry will be an area we will be closely monitoring.

Become a ERD Services premium reader to access all of your content, by contacting us at dominique@ERDservices.org.

The revenue growth of HCL Tech’s ERS unit continued to be high in Q3 FY19 to 17.4% yoy at CC. Revenues well above the half-billion threshold, to USD 562m, comforting HCL Tech as the third largest ER&D service vendor globally.

KPIT quietly finalized its merger with the privately-owned Birlasoft. The new company is now called Birlasoft and will be an IT service pure-play. Birlasoft has carved out its automotive engineering business that will be called KPIT.

Cyient’s revenues were up 8.6% yoy and up 10.7% yoy at CC in Q3 FY19 to $165m.

It is striking to see how few onshore ER&D service vendors have built a significant Indian or nearshore presence. Onshore vendors do acknowledge that the Indian ER&D service vendors grow faster than they do but argue that most of the Indian vendors service U.S. clients or industries (mostly, ISVs, technology vendors and telecom equipment manufacturers) they do not quite address.

2018 was an eventful year: the top ER&D vendors accelerated their M&A activities. Alten continued to deploy its business model. HCL Tech’s ERS unit had a superb year

The USD 1.8bn HCL Tech deal is undoubtedly impressive and does raise many questions about the

We learned a bit more about the rationale of this USD 1.8bn deal under which HCL

In an interview published on LinkedIn, Warren Harris, the CEO of Tata Technologies (TTL) confirmed that

In an interview with Indian business paper the Economic Times, GlobalLogic expressed its intentions to reach

QuESTGlobal Services has big ambitions in Germany, where it intends to double its headcount in the

UDATED: Cyient: Another Solid Performance in Q2 FY18 Cyient continued, in Q2 FY19, to enjoy double-digit

HCL Tech’s ERS unit had another impressive performance with a CC growth in Q2 FY19 of