UPDATED: 2017 Revenue Growth Rankings: HCL Tech Dominates by Far

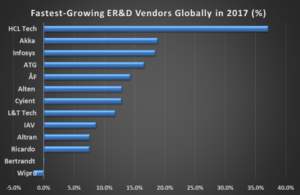

ERDservices is pleased to announce its ranking of the fastest-growing ER&D service vendors in CY 2017. Note that this ranking is based on reported numbers (and not on CC or CC/CS numbers). More about the methodology below the chart.

HCL Tech Had a Superb Performance in 2017

The big surprise of the year was the performance of HCL Technologies, which has had a stop and go strategy in the past three to four years, with strong growth initially led by four large deals, and then several quarters of plateau-ing. Since early 2017, HCL is in a high growth mode for three reasons:

- CC/CS growth with HCL tech benefiting from favorable market conditions

- The acquisitions of Geometric in PLM, and Butler Aerospace

- Its bold IP partnership with IBM, which YTD represents an investment of USD 1.1bn-1.2bn in our estimate. More information here. We estimate that this IBM partnership represents half of the revenue growth of HCL Tech’s ERS unit.

Then Akka and Infosys had similar growth, in the range of 18%-19%. Dynamics are different, with Akka deploying its model of acquisitions and organic growth. Infosys had a purely organic performance this year. Finally, with a 17% revenue growth, ATG is benefiting from its positioning currently centered around the European aerospace and automotive industries.

How Will 2018 Look Like?

Let’s speculate on how 2018 will look like next year, based on what we know already:

- Altran with its acquisition of Aricent now completed at end of Q3 2018, with adding ~20% in revenue growth alone. Add organic growth in the range of 5%-10% and potentially subtract 5% in growth due to the immense task of integrating Aricent: we are looking at 25% growth for Altran this year

- ATG completed the acquisition of SQS by early February 2018, representing a 45% growth for 2018. We are guessing organic growth will be 10% in 2018. In total, this means approximately 55% in growth in 2018. Of course, SQS is an IT service firm specialized in software testing, while ATG is pure ER&D vendor.

These are the facts. Let’s now speculate:

- ÅF and Akka have stated their intentions to make one large acquisition. This may or may not happen in 2018. We are guessing both firms will try to finalize these large transactions this year

- While we understand the mechanism of the IP partnership that IBM has negotiated, mostly with HCL Tech, but also with Tech Mahindra and Aricent, and another 5 (we estimate) other partners, we do quite understand the impact, and in particular: how long the effect of ER&D spending IBM on the revenues of HCL and other partners will last. It is not quite clear either when the impact of shared software license revenues will benefit partners. We cannot rule out a decline in IBM ER&D spending, when the IBM software products have completed their product refresh

- With this in mind, we are guessing the impact of the IBM partnership on HCL Tech ERS will last most of 2018

- Finally, for all vendors: our assumption is that organic growth will be of a similar level in 2018, compared to 2017. We estimate the organic growth in 2018 to be in the 5%-10% range.

More information about the methodology: we have considered:

- Listed ER&D vendor and listed IT service vendors that provide revenue breakdowns. In addition, we have used information shared by IAV

- Reported numbers as a basis for growth

- Specifically: EDAG has not yet reported its Q4 2017 revenue and we have therefore not included it in our these rankings. For ATG, we have taken a full-year full based on pro-forma revenues provided by Assystem. Altran, we have not excluded the revenues of the US utility engineering company that Altran divested late 2017.